Fueling an equitable recovery for small businesses

The challenge

The COVID-19 pandemic wrought economic turmoil across Washington’s smallest businesses and nonprofits, but for many businesses owned by historically-excluded communities, the pandemic exacerbated economic inequities that small businesses had been struggling with for years or decades. Small, community-based businesses are the backbone of our economy, but many clung to survival even before the pandemic on a month-to-month basis, unable to secure loans for future stability and growth.

Washington State Department of Commerce and the National Development Council (now Grow America) sought to address that and provide access to flexible, working capital for those who had previously been denied access. By bringing together key players, they had the ability to create change. They assembled a network of Community Development Financial Institutions (CDFIs) who, as non-profit lenders, have been serving underbanked communities for decades, technical assistance providers who would help businesses with financial literacy, language assistance and understanding how to become bankable, as well as investors from the private sector who would add to Commerce’s $30 million seed contribution to the fund. In the end, they created a fund designed to support the smallest rural-based and BIPOC, LGBTQ+, Veteran and women-owned organizations in Washington during this — and future — economic crises in through low-interest, flexible loans.

Amid the confusion of the pandemic, small businesses were inundated with similar programs, offers and, frankly, a wall of confusing resources that all looked the same but were technically challenging to engage. PPP loans were complicated to apply for and negatively perceived by most small businesses, and with historically low distrust of government, Commerce’s fund needed to be positioned differently to diverse business owners across the state.

Strategy/approach

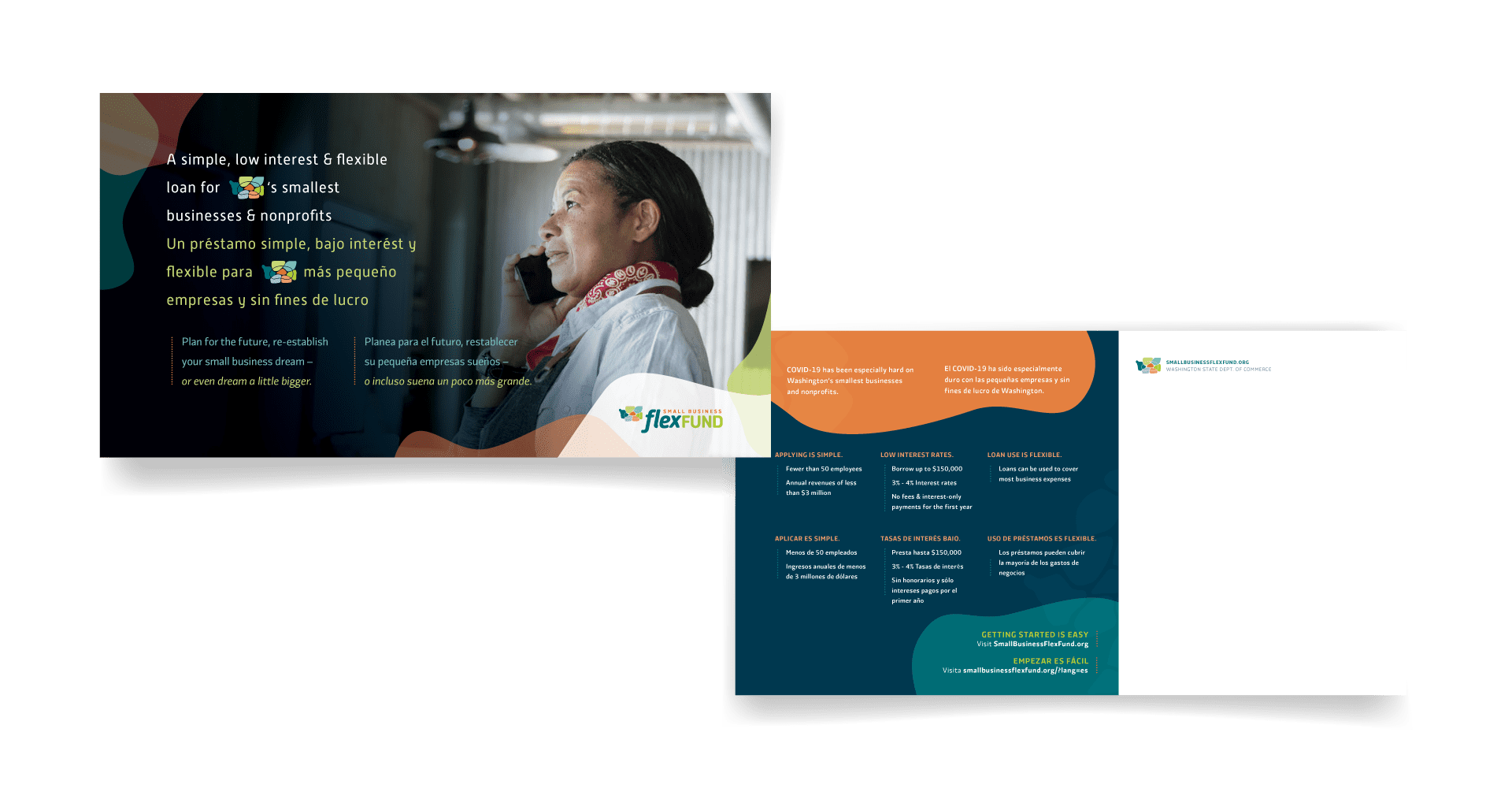

Commerce and National Development Council partnered with DH to name the fund, establish an accessible message platform/value proposition and a unique visual identity to stand out amid the marketplace confusion. This process included insight interviews with small business owners to understand their needs and barriers to engaging in a program like this. We also conducted a competitive landscape of the colors, design styles and messages of other similar programs, banks and CDFIs themselves to find a place where this fund could stand out. Key messages focused on framing the loans as from trusted community organizations and not big government,

the value of flexible loans tailored for Washington's smallest businesses and the program's ability to create stability and growth.

Promoting the Small Business Flex Fund — a name emphasizing its flexibility — to diverse small business owners required an equity-based campaign approach — meaning the program couldn’t rely only simply on targeted advertising or government owned media channels. It required investments in deep partnership with community-based organizations (CBOs) and the local CDFI’s who were already serving the communities we wanted this program to reach. Building awareness and credibility for the fund meant working with trusted message carriers in these communities to familiarize them with the program, make sure it felt like a good fit for their communities, fund them for their time and collaboration, and then equip them with the customized materials and tools needed to spread the word to their networks.

What we did

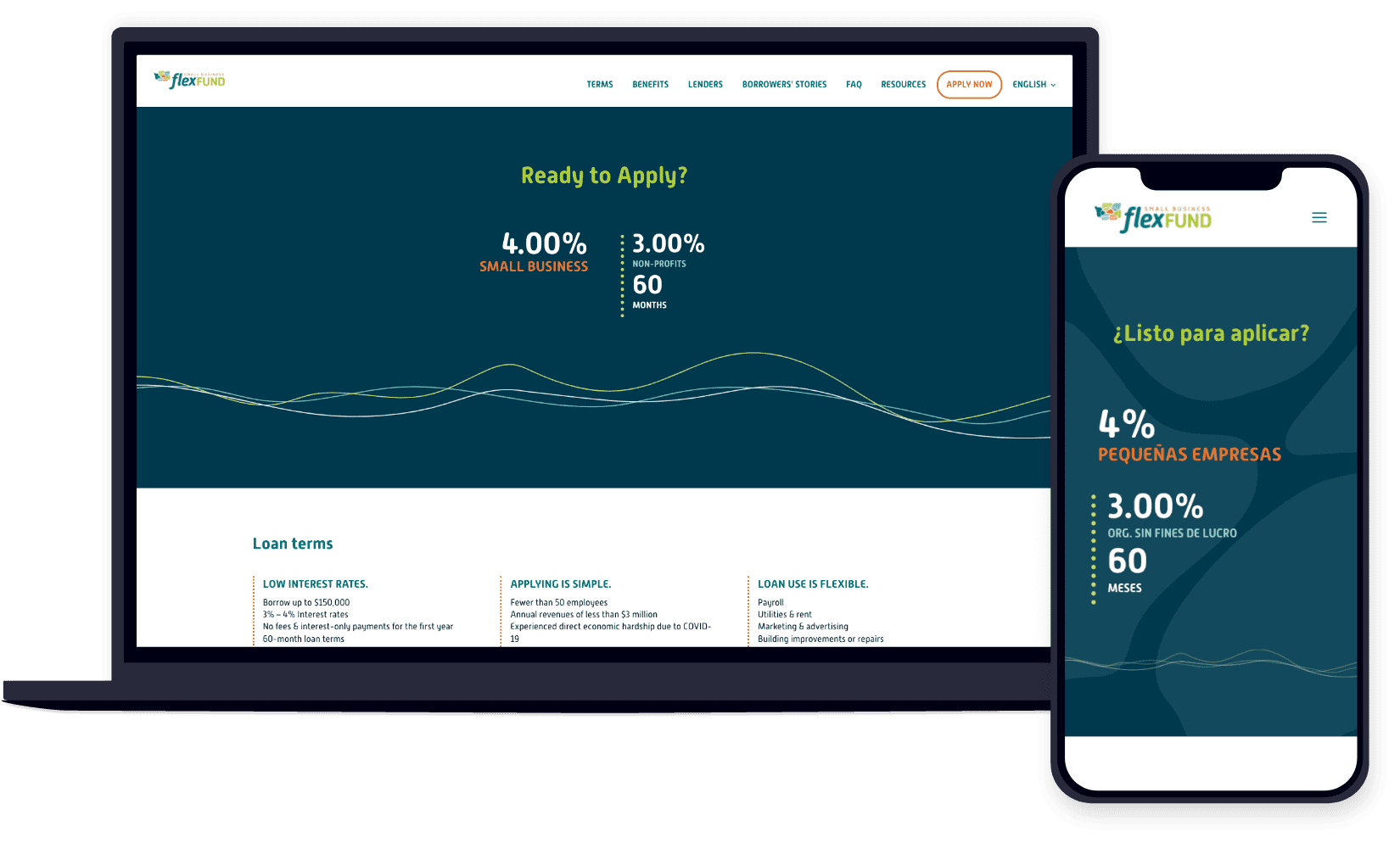

The program launched with a website in nine languages to maximize its accessibility, with easy-to-understand video and collateral content in a robust partner toolkit for CDFIs and CBOs to share in their communities. Collaboration with CBOs was foundational to our overall approach in reaching our key audiences and they helped spread the word as trusted sources within communities across the state. For example, we worked with our community-based organization partners to tailor messaging and materials for a media pitch, securing coverage on two regional Korean news sites. DH also developed content and messaging to support cities like Kent and Issaquah with direct outreach to businesses in their districts.

DH launched a statewide media buy, specifically geared to reach non-white small business owners. More than 22,000 direct mail pieces were sent to small businesses in rural zip codes, and over 8,000 Spanish-language mailers were sent to zip codes with high LatinX populations. DH placed 36 paid print placements in local outlets across the state that serve BIPOC audiences. The digital ad campaign secured more than 53,000 clicks and 18M impressions.

To get underneath barriers uncovered in our research — such as fear of debt and distrust of big banks — we created testimonial videos from diverse small business owners so that business owners across Washington could truly see themselves in the fund’s advertising. In these videos, business owners who had applied and received funding spoke to the ease and efficacy of the fund, helping to encourage applications in under-resourced and under-banked communities.

Borrower’s Stories

The Results

In the first round of the program spanning from 2021 to 2023, more than 1,072 small businesses and nonprofits were funded, totaling over $93.4 million in loans distributed. Of those funded organizations, almost 78% had diverse ownership.

Washington’s Flex Fund had the best conversation rate compared to similar programs in other states (like New York and California), at 1 loan funded for every 11.9 applicants – with other states closer to one loan per 18 applicants. This rate is a testament to our effective tactics, which led to higher quality referrals, and ultimately, more capital in the hands of businesses that need them the most.

The fund has gained visibility over the years; to date, it has been the subject of 550 news articles with a potential reach of over 560 million, including a notable feature in Forbes. Locally, we helped author an op-ed in the Seattle Times. Over 2 million paid media impressions have been generated through statewide marketing efforts specifically intended to reach diverse business owners with 50 or fewer full-time employees.

Through a strategic approach, and by continuing to invest in and empower local community based organizations, the Small Business Flex Fund achieved its goal of getting flexible, affordable capital into the hands of our smallest businesses and nonprofits – and in turn strengthened communities through small business resiliency — something all Washingtonians rely upon for economic vitality.

In the spring of 2024, the Fund relaunched with updated terms and it continues to serve small businesses throughout Washington.